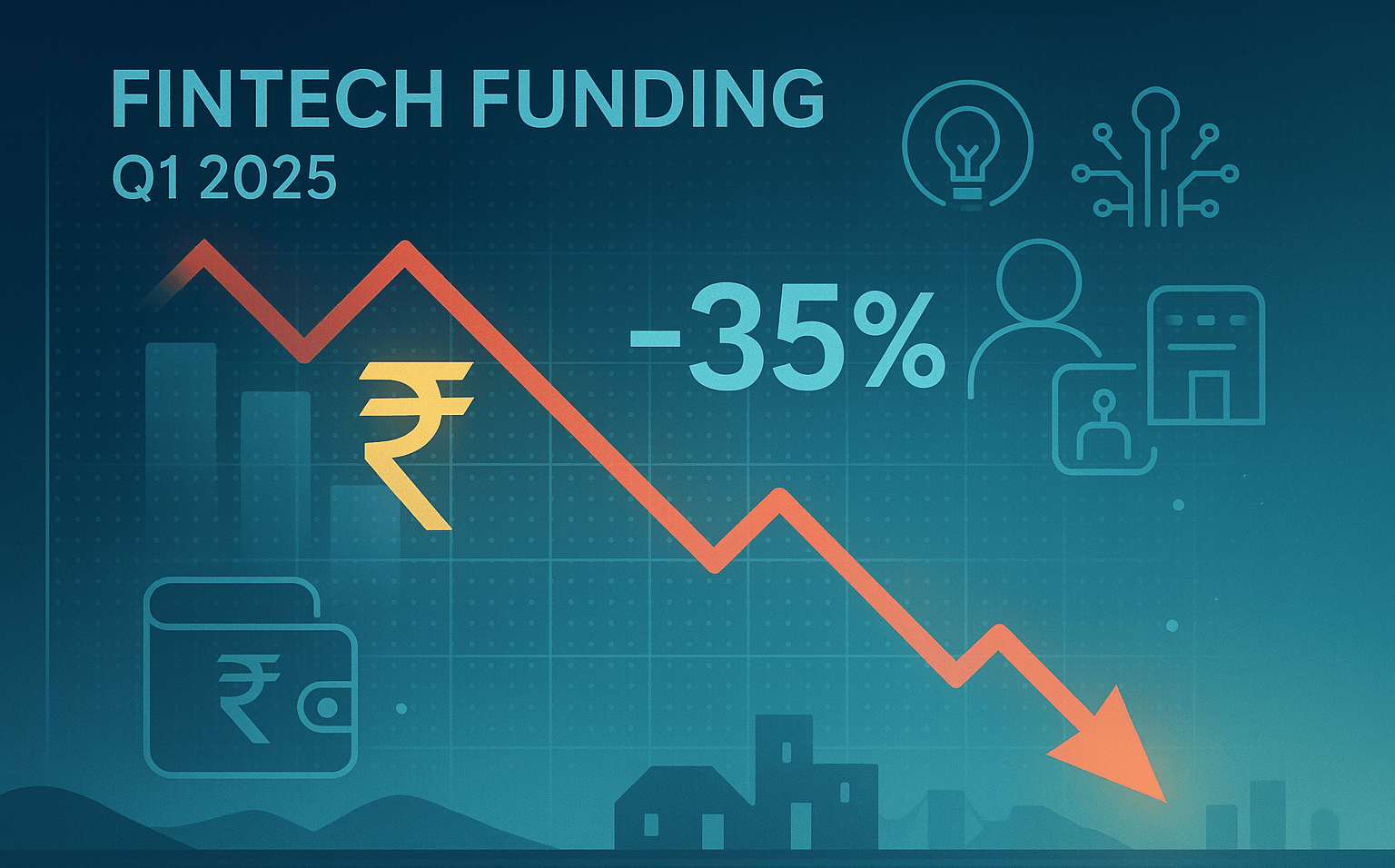

Fintech Funding in India Declines by 35% in Q1 2025: What It Means for the Sector

India’s fintech landscape, long celebrated for its innovation and exponential growth, is witnessing a notable correction. According to recent reports, fintech funding in India dropped by 35% year-over-year in the first quarter of 2025, amounting to $366 million, compared to $568 million in Q1 2024. The slowdown, while not entirely unexpected, signals a shift in investor sentiment and a recalibration of strategies in the fintech ecosystem.

Funding Breakdown: Fewer Big Bets, More Consolidation

The decline in overall funding is primarily attributed to a dip in late-stage investments, which stood at $227 million, with fewer mega-deals observed. Meanwhile, early-stage and seed rounds contributed $138.5 million, suggesting that investors remain cautiously optimistic about backing promising startups at the idea or product-market fit stage.

Perhaps more telling is the absence of new unicorns or IPOs during the quarter — a clear deviation from the startup boom witnessed in 2021–2022.

At the same time, the industry saw a spike in mergers and acquisitions (M&A) activity, with 10 fintech firms getting acquired in Q1 2025. This trend indicates a wave of consolidation in the ecosystem, as smaller players seek exits and larger ones aim to expand their capabilities and customer base.

Why the Slowdown?

Several factors have contributed to this funding dip:

- Macroeconomic uncertainties globally and rising interest rates have made capital more expensive.

- Investors are placing greater scrutiny on unit economics, demanding profitability over growth-at-any-cost.

- Regulatory tightening in the digital lending and payments space has also made VCs more cautious.

- A cooling-off from the funding highs of previous years, where valuations were inflated.

Sector-Specific Impacts

- Digital Lending: Startups in the lending space have been hit the hardest due to recent RBI mandates and rising NPAs (non-performing assets).

- WealthTech & InsurTech: These sub-sectors are experiencing a cautious pause, with investors waiting for clearer regulatory signals.

- Payments: While the UPI-driven market remains robust, new entrants are finding it harder to raise capital amid increasing competition and tighter margins.

What Lies Ahead for Indian Fintech?

Despite the short-term dip, the long-term outlook remains strong:

- India’s digital payment ecosystem continues to be one of the fastest-growing globally.

- The emphasis on financial inclusion, driven by government policies, continues to unlock new user bases.

- Emerging technologies like blockchain, AI, and embedded finance will continue to attract investor interest.

- The “reset” in valuations and funding discipline could lead to more sustainable growth and healthier businesses.

Investor Sentiment: From FOMO to Fundamentals

This slowdown is not a death knell — it's a correction. Investors are no longer driven by FOMO (Fear Of Missing Out). Instead, they are focused on fundamentals: revenue growth, customer retention, compliance readiness, and profitability.

Startups that align with these fundamentals will continue to attract funding, albeit at more realistic valuations and with a greater emphasis on business maturity.

Conclusion

The 35% decline in Q1 2025 fintech funding is a reality check — not a retreat. As India’s fintech sector matures, we are entering a phase where resilience, innovation, and regulatory agility will matter more than ever. The market is evolving, and only those ready to adapt will thrive.

Recent post

Take Fintegriti for a Test Drive

No License Required!

Still on the fence? Hop in and experience payments so smooth,

even your morning coffee will be jealous